The following packages are required for the random forest

if(!require(tidyverse)){install.packages("tidyverse");library(tidyverse)}

if(!require(janitor)){install.packages("janitor");library(janitor)} # for rename

if(!require(randomForest)){install.packages("randomForest");library(randomForest)}

if(!require(caret)){install.packages("caret");library(caret)} # for `confustionMatrix`A Random forest is made of Random Trees

Data <- read_csv(file = here::here("content/post/2022-06-26-random-forest", "german_credit.csv"))Exploring the dataset

Data <- clean_names(Data)

Data$creditability <- as.factor(Data$creditability)

glimpse(Data)

## Rows: 1,000

## Columns: 21

## $ creditability <fct> 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, …

## $ account_balance <dbl> 1, 1, 2, 1, 1, 1, 1, 1, 4, 2, 1, 1, …

## $ duration_of_credit_month <dbl> 18, 9, 12, 12, 12, 10, 8, 6, 18, 24,…

## $ payment_status_of_previous_credit <dbl> 4, 4, 2, 4, 4, 4, 4, 4, 4, 2, 4, 4, …

## $ purpose <dbl> 2, 0, 9, 0, 0, 0, 0, 0, 3, 3, 0, 1, …

## $ credit_amount <dbl> 1049, 2799, 841, 2122, 2171, 2241, 3…

## $ value_savings_stocks <dbl> 1, 1, 2, 1, 1, 1, 1, 1, 1, 3, 1, 2, …

## $ length_of_current_employment <dbl> 2, 3, 4, 3, 3, 2, 4, 2, 1, 1, 3, 4, …

## $ instalment_per_cent <dbl> 4, 2, 2, 3, 4, 1, 1, 2, 4, 1, 2, 1, …

## $ sex_marital_status <dbl> 2, 3, 2, 3, 3, 3, 3, 3, 2, 2, 3, 4, …

## $ guarantors <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, …

## $ duration_in_current_address <dbl> 4, 2, 4, 2, 4, 3, 4, 4, 4, 4, 2, 4, …

## $ most_valuable_available_asset <dbl> 2, 1, 1, 1, 2, 1, 1, 1, 3, 4, 1, 3, …

## $ age_years <dbl> 21, 36, 23, 39, 38, 48, 39, 40, 65, …

## $ concurrent_credits <dbl> 3, 3, 3, 3, 1, 3, 3, 3, 3, 3, 3, 3, …

## $ type_of_apartment <dbl> 1, 1, 1, 1, 2, 1, 2, 2, 2, 1, 1, 1, …

## $ no_of_credits_at_this_bank <dbl> 1, 2, 1, 2, 2, 2, 2, 1, 2, 1, 2, 2, …

## $ occupation <dbl> 3, 3, 2, 2, 2, 2, 2, 2, 1, 1, 3, 3, …

## $ no_of_dependents <dbl> 1, 2, 1, 2, 1, 2, 1, 2, 1, 1, 2, 1, …

## $ telephone <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, …

## $ foreign_worker <dbl> 1, 1, 1, 2, 2, 2, 2, 2, 1, 1, 1, 1, …Assess the creditabiliy with the help of other variables

# code -------------------------------------------------------------------------

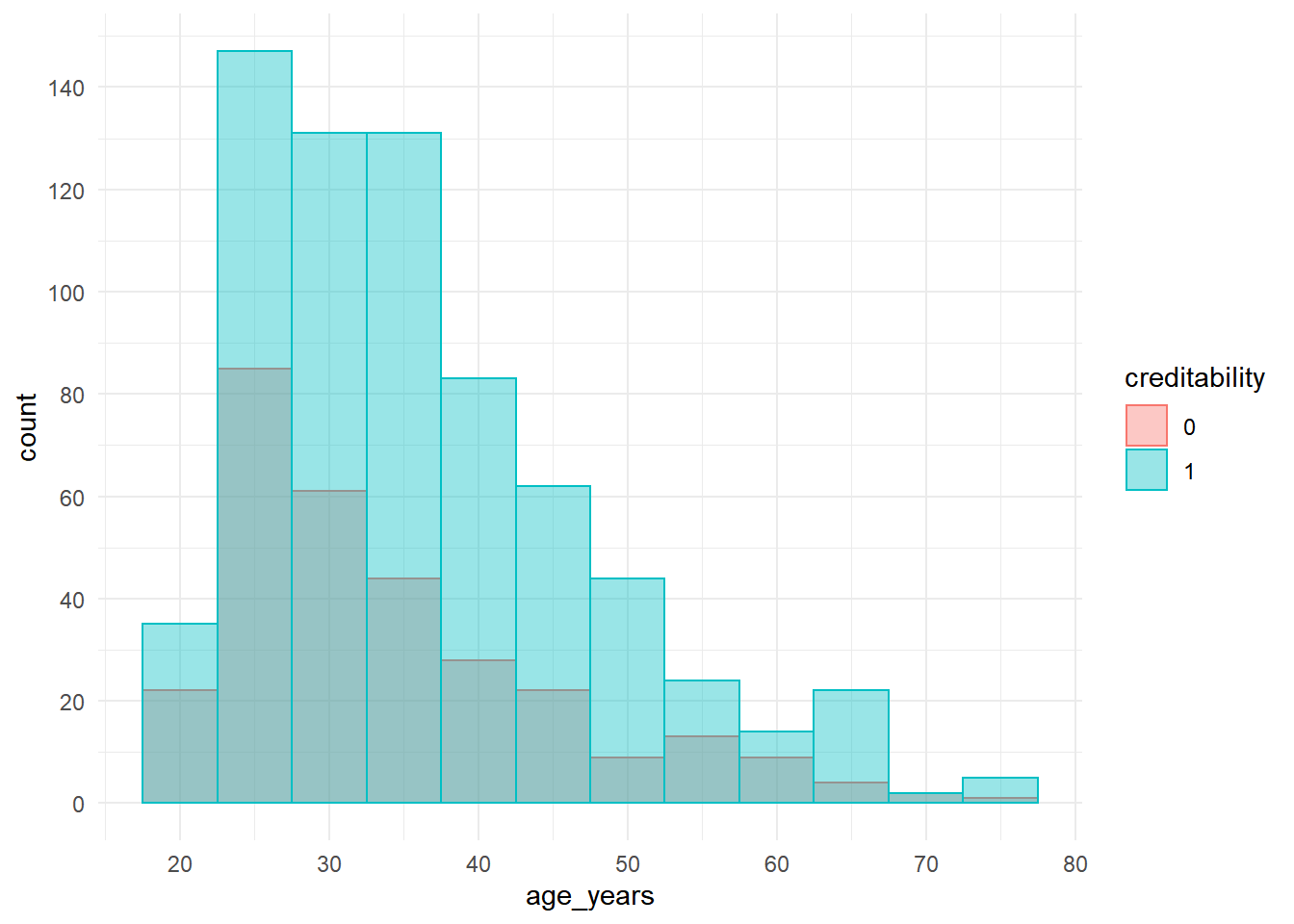

ggplot(data = Data, aes(x = age_years, color = creditability, fill = creditability)) +

geom_histogram(binwidth = 5, position = "identity", alpha = 0.4) +

scale_x_continuous(breaks = scales::pretty_breaks(n = 6)) +

scale_y_continuous(breaks = scales::pretty_breaks(n = 6)) + theme_minimal()

# Create a training and testing data

set.seed(7791)

partitioning <- sample(2, nrow(Data), replace = TRUE, prob = c(0.8, 0.2))

table(partitioning)

## partitioning

## 1 2

## 797 203

train <- Data[partitioning == 1, ]

table(train$creditability)

##

## 0 1

## 244 553

test <- Data[partitioning == 2, ]

table(test$creditability)

##

## 0 1

## 56 147Train the Random forest model

# Generate random forest with train data

rf_model <- randomForest(formula = creditability ~ ., data = train)

predict_train <- predict(rf_model, train)

confusionMatrix(predict_train, train$creditability)

## Confusion Matrix and Statistics

##

## Reference

## Prediction 0 1

## 0 244 0

## 1 0 553

##

## Accuracy : 1

## 95% CI : (0.9954, 1)

## No Information Rate : 0.6939

## P-Value [Acc > NIR] : < 2.2e-16

##

## Kappa : 1

##

## Mcnemar's Test P-Value : NA

##

## Sensitivity : 1.0000

## Specificity : 1.0000

## Pos Pred Value : 1.0000

## Neg Pred Value : 1.0000

## Prevalence : 0.3061

## Detection Rate : 0.3061

## Detection Prevalence : 0.3061

## Balanced Accuracy : 1.0000

##

## 'Positive' Class : 0

## Testing the model rf_model on test data

predict_test <- predict(rf_model, test)

confusionMatrix(predict_test, test$creditability)

## Confusion Matrix and Statistics

##

## Reference

## Prediction 0 1

## 0 28 12

## 1 28 135

##

## Accuracy : 0.803

## 95% CI : (0.7415, 0.8553)

## No Information Rate : 0.7241

## P-Value [Acc > NIR] : 0.006157

##

## Kappa : 0.459

##

## Mcnemar's Test P-Value : 0.017706

##

## Sensitivity : 0.5000

## Specificity : 0.9184

## Pos Pred Value : 0.7000

## Neg Pred Value : 0.8282

## Prevalence : 0.2759

## Detection Rate : 0.1379

## Detection Prevalence : 0.1970

## Balanced Accuracy : 0.7092

##

## 'Positive' Class : 0

##

# Reference

# Prediction 0 1

# 0 29 14

# 1 27 133

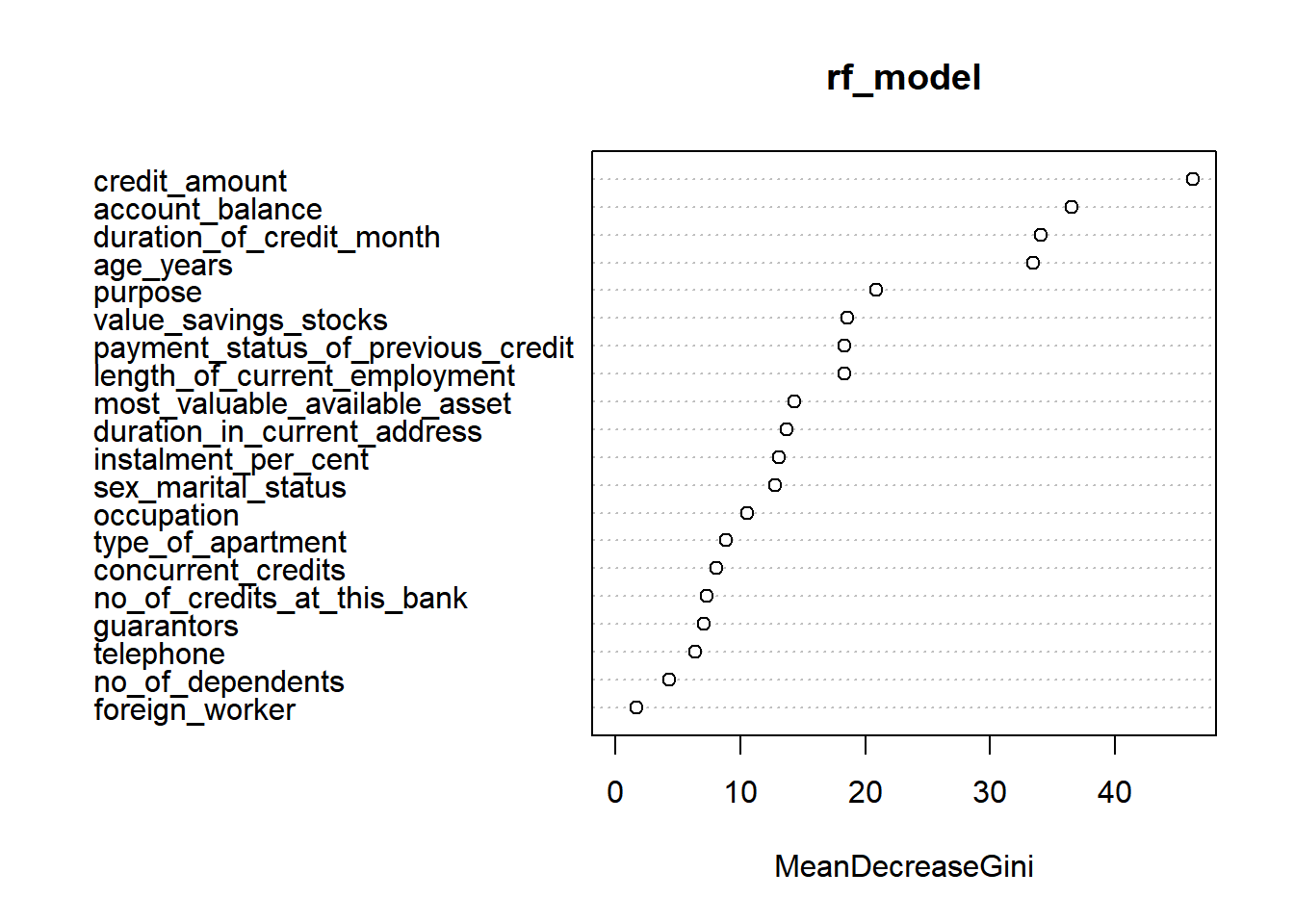

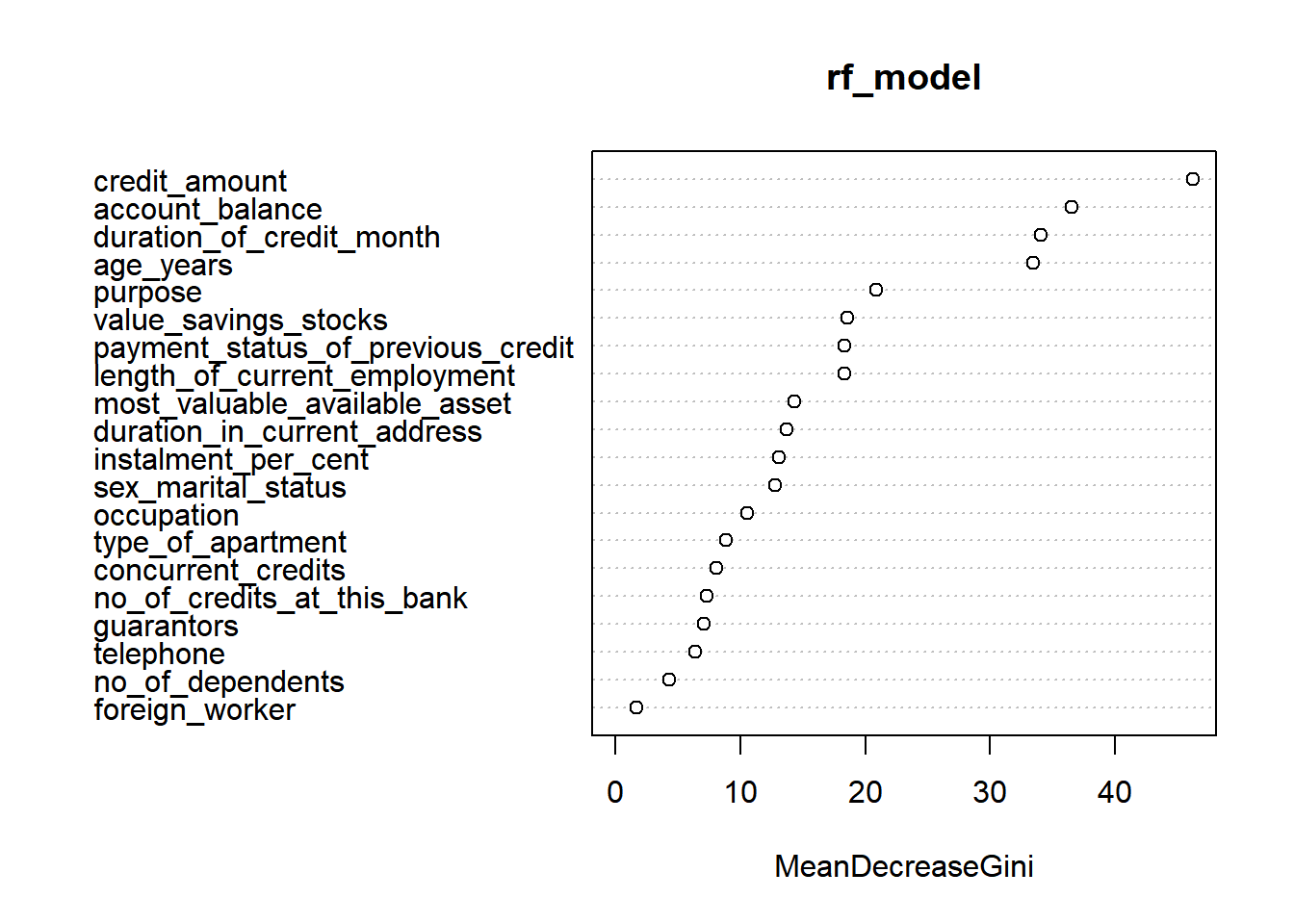

varImpPlot(rf_model)

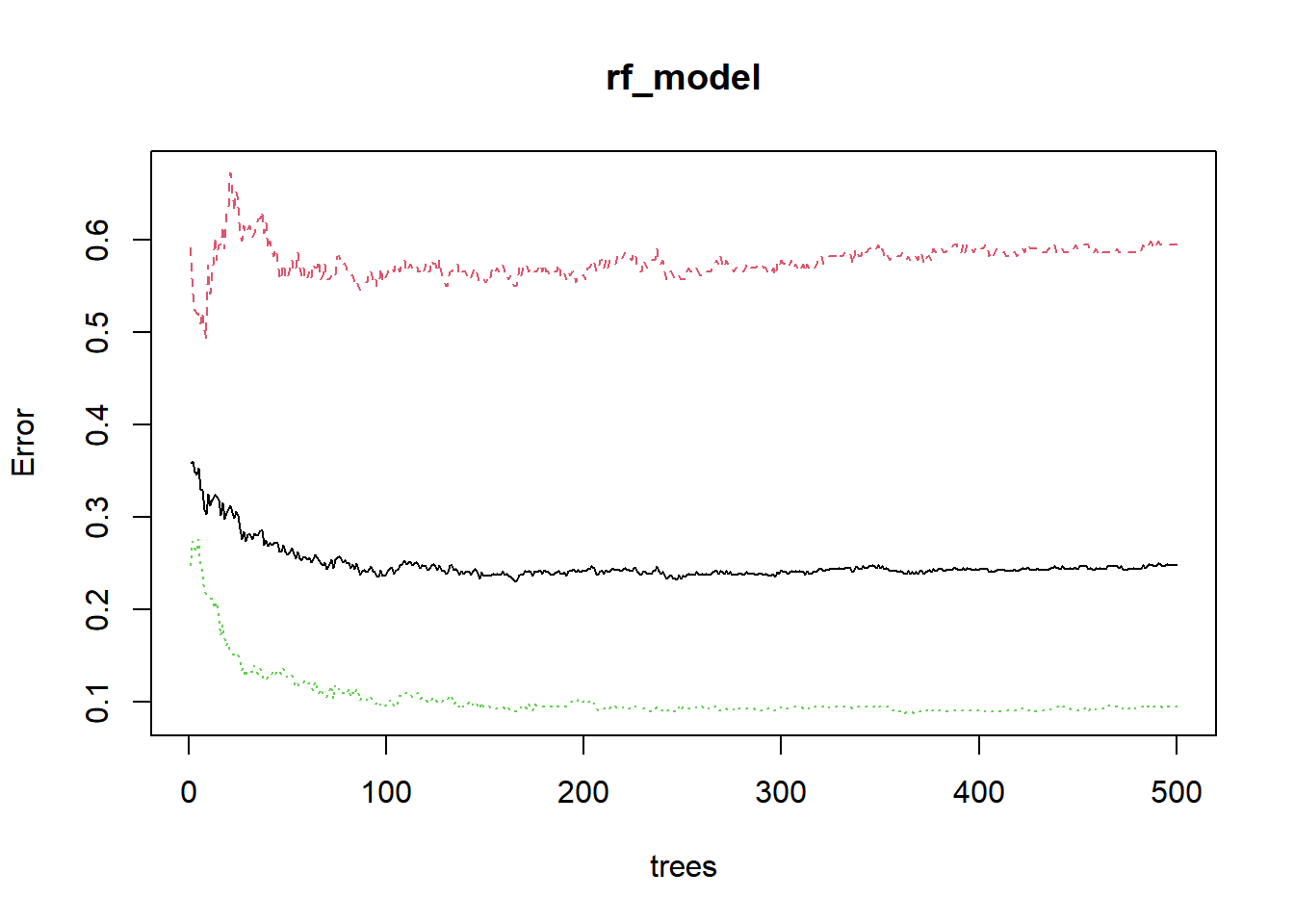

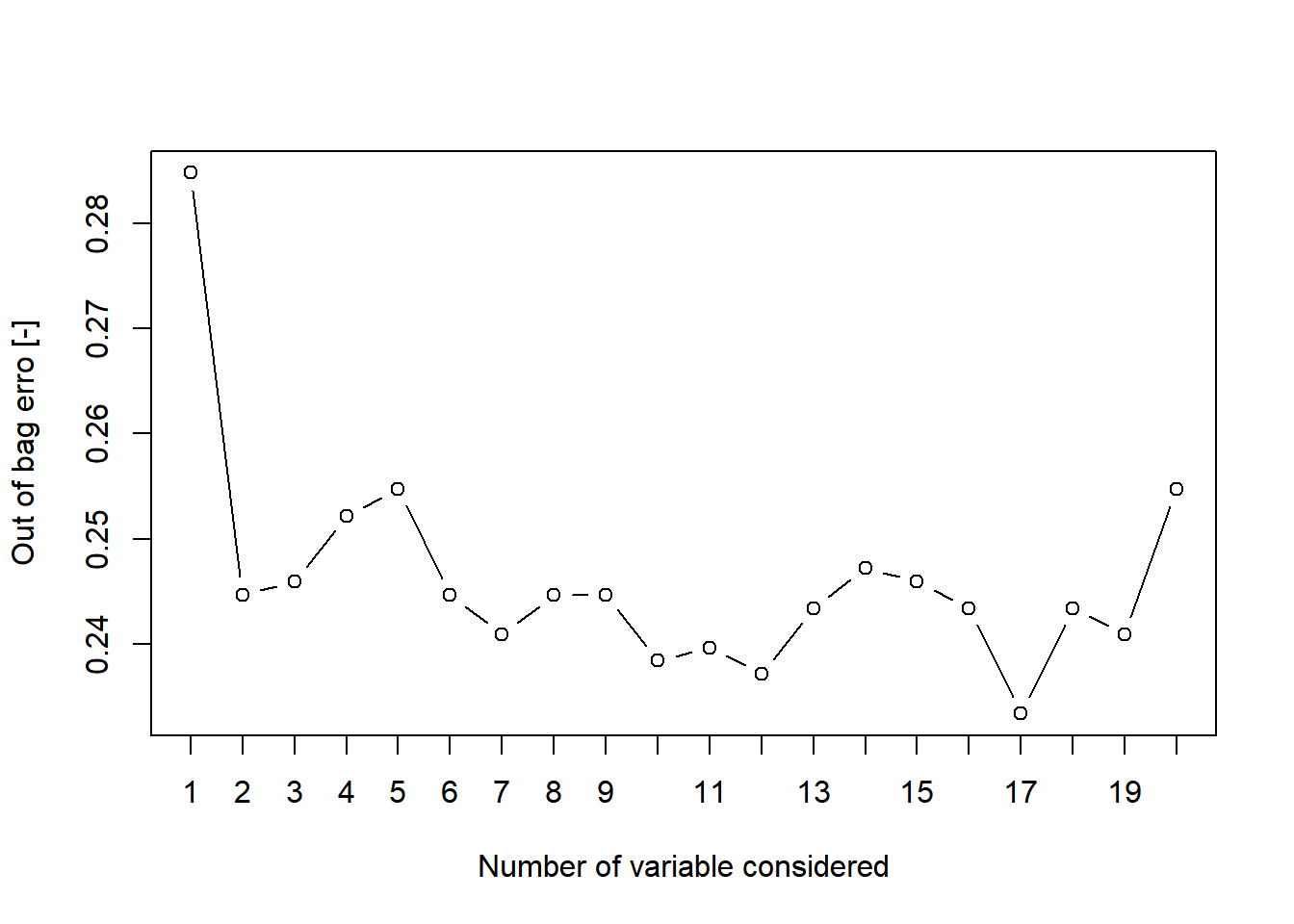

Optimize the performance of randomforest.

plot(rf_model) # black line is out of bag error.

oob_error <- double(20)

for (mtry in 1:20) {

rf <- randomForest(formula = creditability ~ ., data = train, mtry = mtry, ntree = 166)

oob_error[mtry] <- rf$err.rate[166]

}

plot(1:20, oob_error, type = "b", xlab = "Number of variable considered", ylab = "Out of bag erro [-]", xaxt = "n")

axis(1, at = 1:20, labels = 1:20, cex = 0.8)

opti_num_var = which.min(oob_error)Re running the random forest with optimum number of variables

rf_optim <- randomForest(formula = creditability ~ ., data = train, mtry = opti_num_var, ntree = 166)

# Testing the model `rf_model` on test data

confusionMatrix(predict(rf_optim, test), test$creditability)

## Confusion Matrix and Statistics

##

## Reference

## Prediction 0 1

## 0 33 20

## 1 23 127

##

## Accuracy : 0.7882

## 95% CI : (0.7255, 0.8423)

## No Information Rate : 0.7241

## P-Value [Acc > NIR] : 0.02266

##

## Kappa : 0.4609

##

## Mcnemar's Test P-Value : 0.76037

##

## Sensitivity : 0.5893

## Specificity : 0.8639

## Pos Pred Value : 0.6226

## Neg Pred Value : 0.8467

## Prevalence : 0.2759

## Detection Rate : 0.1626

## Detection Prevalence : 0.2611

## Balanced Accuracy : 0.7266

##

## 'Positive' Class : 0

## Exploring useful variables

train <- as.data.frame(train)

varImpPlot(rf_model)

importance(rf_model)

## MeanDecreaseGini

## account_balance 36.543019

## duration_of_credit_month 34.072986

## payment_status_of_previous_credit 18.303982

## purpose 20.837156

## credit_amount 46.208519

## value_savings_stocks 18.564843

## length_of_current_employment 18.296281

## instalment_per_cent 13.122638

## sex_marital_status 12.781397

## guarantors 7.055415

## duration_in_current_address 13.666627

## most_valuable_available_asset 14.340330

## age_years 33.451374

## concurrent_credits 8.064289

## type_of_apartment 8.821601

## no_of_credits_at_this_bank 7.306201

## occupation 10.567355

## no_of_dependents 4.325819

## telephone 6.359517

## foreign_worker 1.666973

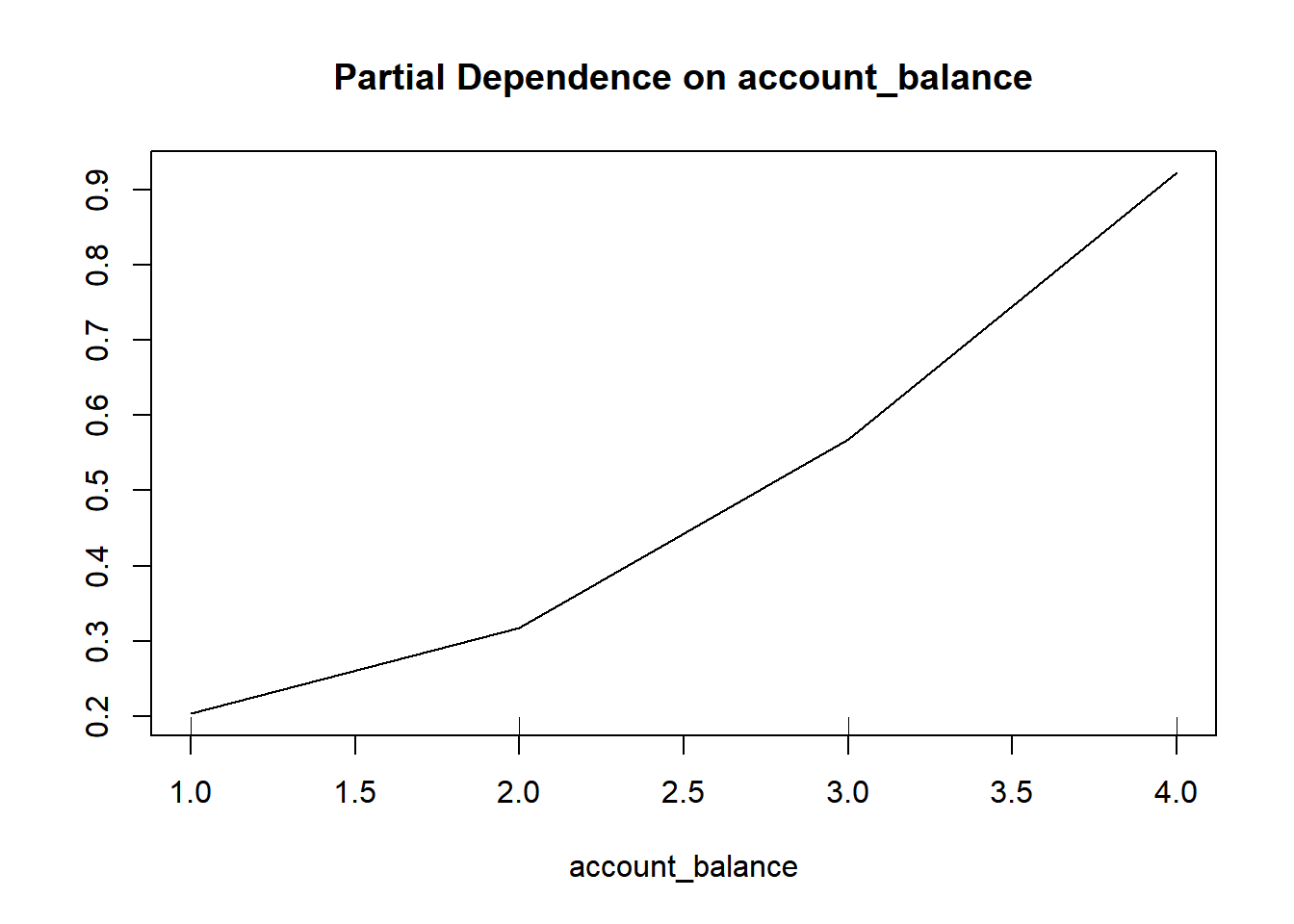

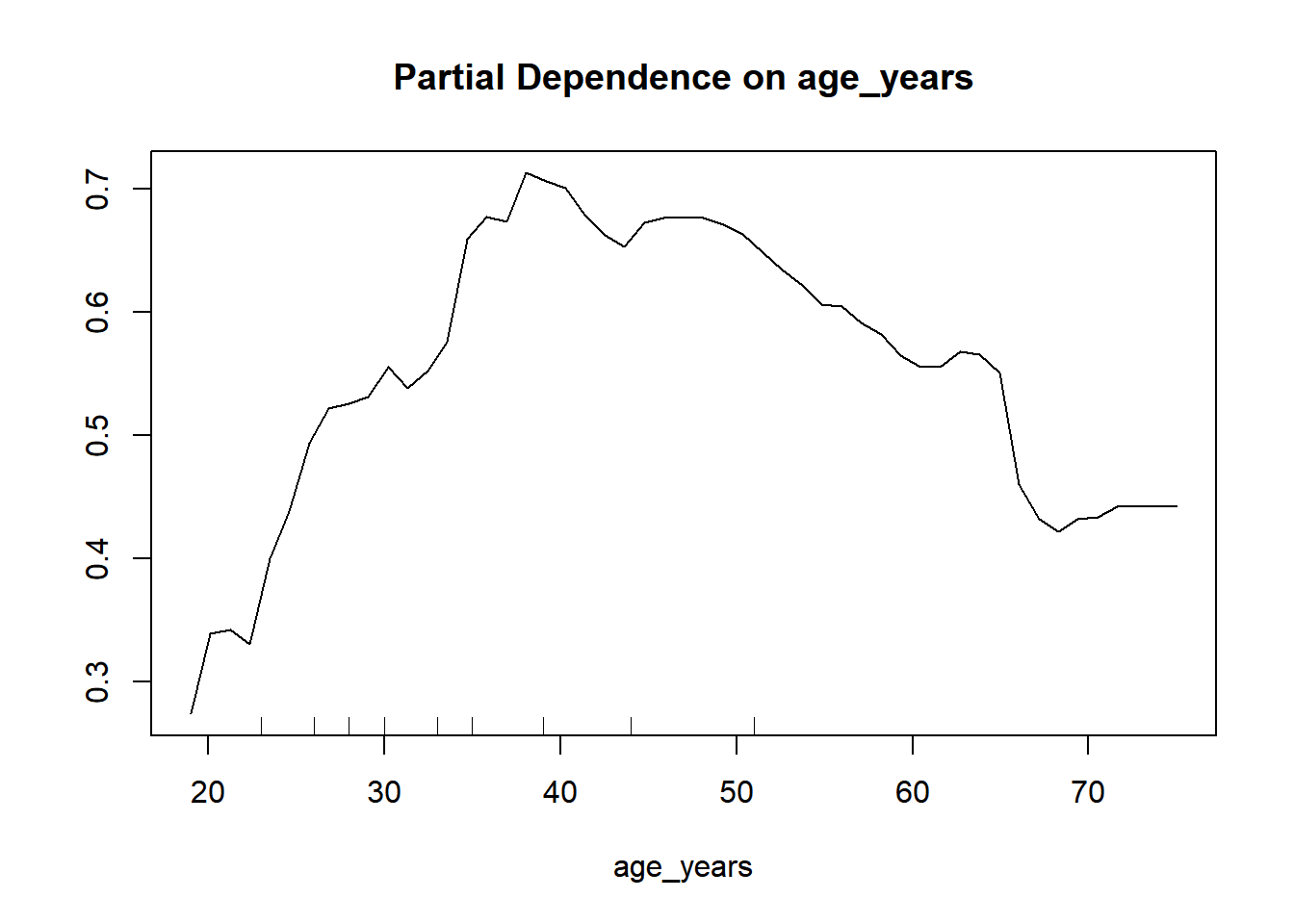

# How variable affect the chance of getting loan.

partialPlot(rf_model, train, account_balance, "1")

partialPlot(rf_model, train, age_years, "1")

This analysis for discrete variable of creditability.